User Tools

Sidebar

Minimum Wage Compliance

CareFree provides the facility to run a report which will check that your staff meet the national minimum wage. It is the responsibility of the management team to make sure your company is being compliant.

Set up

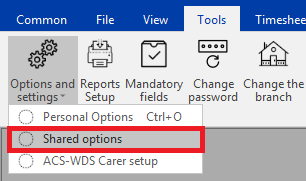

To make sure that the report works correctly, it first requires to be set up. First, access shared options. You can find this by clicking tools then options and settings on the menu bar:

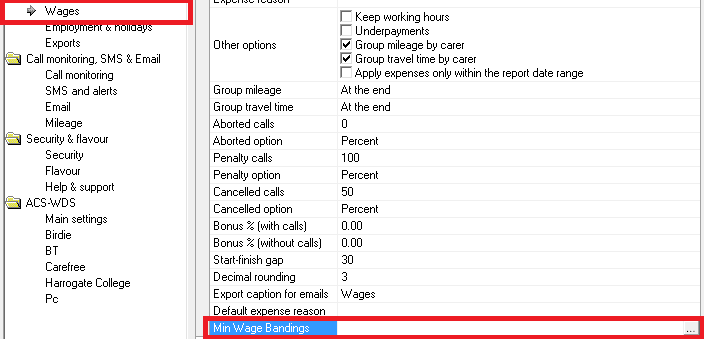

Selecting Wages will allow you to navigate to Min Wage Bandings.

Pressing the the ellipsis (…) button will launch the Min Wage Bandings Menu.

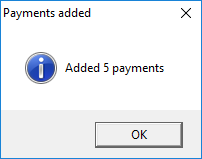

Back in the shared options, navigate to the Employment & Holidays:

(Click image to increase size)

(Click image to increase size)

Change the minimum pay per hour to the correct amount, and also choose a top up expense type, if you do not have a relevant expense type more can be added under items > expense reasons.

Tick Automatically add top-ups to add all national minimum wage top-ups automatically without having to manually pay the carers via the report. This happens if the total pay within the pay period is deemed as not being compliant.

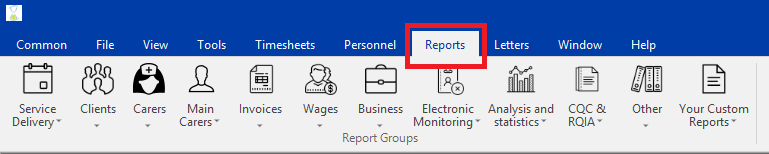

Now lets run the report, from the main menu select Reports:

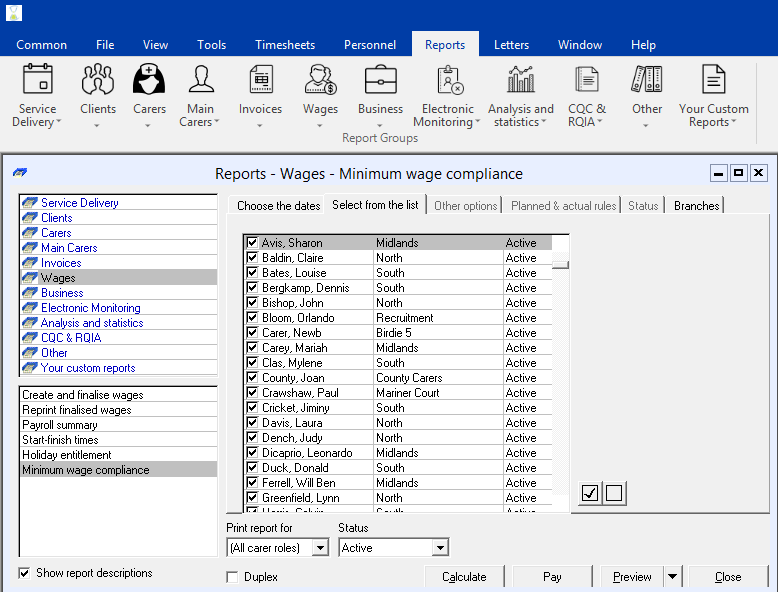

Once in the reports section, navigate to wages then Minimum wage compliance:

On the first tab, choose the dates which you want to run the minimum wage check for, this will most likely coincide with your wage run dates.

Now click on the tab which says Select from the list:

On this tab make sure to add the people you want to run the check for. Notice how you have some filtering options at the bottom under “Print report for”. This might be useful if you only wanted to check minimum wage compliance for your carers role instead of office managers etc.

Then click the  button. Wait for the calculation to process then press

button. Wait for the calculation to process then press

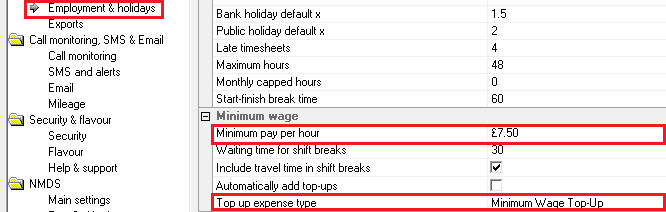

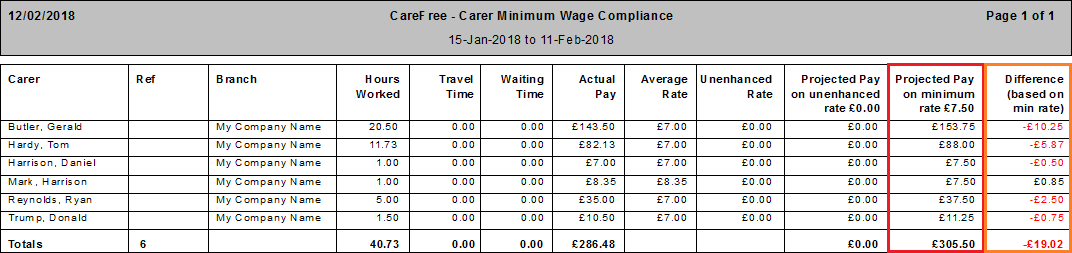

You will then be presented with a report which will look something like this:

(Click image to increase size)

(Click image to increase size)

Looking at the last two columns you have projected pay and the difference which are both based off the minimum rate as previously entered. Check these value along with the actual pay and average rate to make a decision on whether or not you would like to do a top up.

If you would like to make a top-up close the report at the top and then use the  button.

button.

You will then see a dialogue box asking you to confirm the action:

Followed by a confirmation that the adjustments have been added:

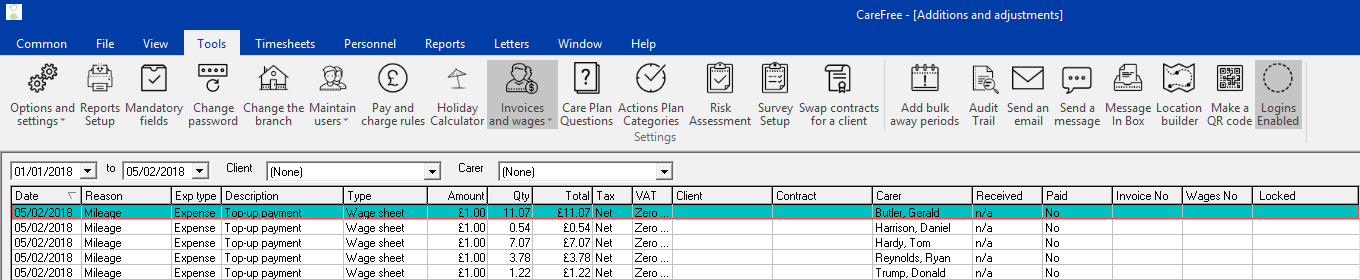

You can then view the expenses in Additions & Adjustments (Tools > Invoices and wages > Additions and adjustments):

(Click image to increase size)

(Click image to increase size)

And the top-up will also appear on the wage sheet when that report is run and finalised.